Get the free consumer caution and homeownership counseling notice form

Show details

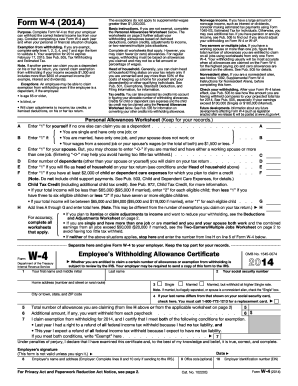

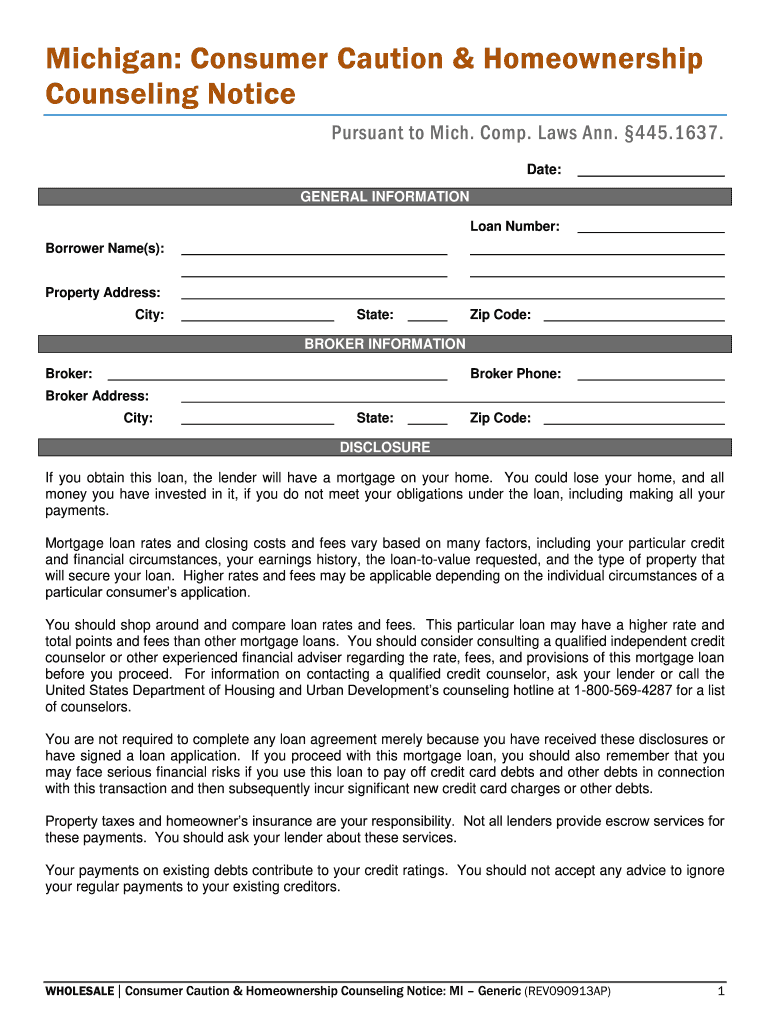

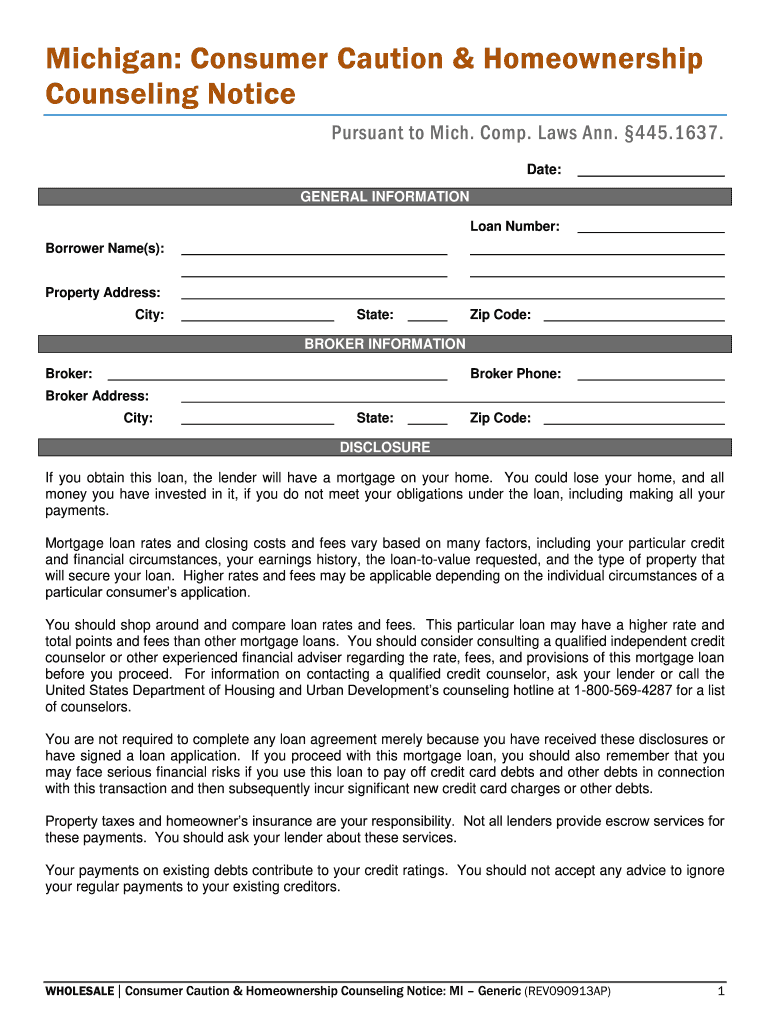

Michigan Consumer Caution Homeownership Counseling Notice Pursuant to Mich. Comp. Laws Ann. 445. 1637. Date GENERAL INFORMATION Loan Number Borrower Name s Property Address City State Zip Code BROKER INFORMATION Broker Broker Phone Broker Address DISCLOSURE If you obtain this loan the lender will have a mortgage on your home. You could lose your home and all money you have invested in it if you do not meet your obligations under the loan including making all your payments. You should not...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your consumer caution and homeownership form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your consumer caution and homeownership form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit consumer caution and homeownership counseling notice online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit consumer caution and homeownership counseling notice. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

How to fill out consumer caution and homeownership

To fill out consumer caution and homeownership, follow these steps:

01

Gather all necessary information: Collect your personal details, including your full name, contact information, and social security number. Additionally, gather any financial documents, such as tax returns, pay stubs, and bank statements.

02

Review the form instructions: Carefully read through the instructions provided with the consumer caution and homeownership form. Make sure you understand all the requirements and any supporting documentation needed.

03

Complete the form accurately: Fill in all the required fields on the form. Provide accurate information and double-check for any mistakes or missing details. Use clear and legible handwriting or type the form if it allows.

04

Attach supporting documentation: Depending on the form, you might need to include supporting documents to verify your financial status or any other relevant information. Make copies of the required documents and attach them securely to the form.

05

Review and proofread: Before submitting the form, go through it again to make sure all the information is correct. Check for any spelling or numerical errors. It's crucial to ensure accuracy to prevent any delays or complications.

06

Submit the form: Once you have completed the consumer caution and homeownership form and reviewed it thoroughly, submit it according to the provided instructions. Follow the specified submission method, whether it is via mail, online submission, or in-person delivery.

Now, let's address who needs consumer caution and homeownership:

Consumer caution and homeownership are essential for individuals or families who are planning to purchase a home or secure a mortgage. These forms often serve as a means for lenders or housing agencies to evaluate an applicant's financial readiness, creditworthiness, and ability to manage homeownership responsibilities.

Therefore, anyone who wishes to apply for a mortgage loan, participate in housing assistance programs, or pursue homeownership opportunities should consider filling out consumer caution and homeownership forms. These forms provide critical information to lenders and help applicants understand their financial capabilities and responsibilities associated with owning a home.

Remember, it's important to consult with professionals or housing counselors if you have any doubts or need guidance throughout the consumer caution and homeownership process.

Fill form : Try Risk Free

People Also Ask about consumer caution and homeownership counseling notice

What does federally related mean?

What loan is considered federally related if it real estate?

What is a federally related loan?

What is the general rule for good faith determinations for estimates of closing costs in the Truth in Lending Act?

What is a loan estimate for a mortgage?

How to locate an approved hud certified housing counselor near you?

What is the special information booklet for home equity transactions called?

What federal law requires lenders to provide housing counseling disclosures to borrowers?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is consumer caution and homeownership?

Consumer caution refers to the careful and cautious approach that consumers take when making purchasing decisions. It involves considering various factors such as product quality, price, reliability, and the reputation of the seller or manufacturer before making a purchase.

Homeownership, on the other hand, refers to the state of owning a home. It is the process of purchasing a property for residential purposes and becoming the legal owner of that property. Homeownership often involves obtaining a mortgage loan, paying monthly mortgage payments, and being responsible for the maintenance and upkeep of the property.

Who is required to file consumer caution and homeownership?

There is no specific individual or group required to file "consumer caution and homeownership." Consumer caution generally refers to individuals being vigilant and informed consumers. Homeownership refers to individuals who own a home. Both aspects are not typically associated with any specific filing requirements.

What is the purpose of consumer caution and homeownership?

The purpose of consumer caution in homeownership is to ensure that individuals make informed and responsible decisions when purchasing or owning a home.

Consumer caution helps individuals understand the potential risks and benefits associated with homeownership. It encourages them to thoroughly research and understand various aspects such as the real estate market, mortgage options, financial implications, property maintenance, and legal obligations.

By exercising caution, consumers can protect themselves from predatory lending, fraudulent practices, and making uninformed decisions that may lead to financial instability or foreclosure. It also empowers individuals to compare different offers, negotiate better terms, and make financially sound choices in safeguarding their investment.

Ultimately, consumer caution in homeownership aims to promote financial literacy, educate individuals about the complexities of real estate transactions, and equip them with the necessary knowledge to make informed decisions that align with their long-term financial goals.

What information must be reported on consumer caution and homeownership?

The information that must be reported on consumer caution and homeownership may vary depending on the specific regulations and requirements of the country or region. However, some common information that is often reported includes:

1. Mortgage Rates: The current interest rates and mortgage terms available to consumers, including fixed-rate and adjustable-rate options.

2. Down Payment Guidance: Information on the typical down payment requirements for purchasing a home, along with any assistance programs or options available.

3. Costs of Homeownership: A breakdown of the costs associated with homeownership, such as property taxes, homeowner's insurance, maintenance costs, and utilities.

4. Affordability Calculations: Guidance on how to calculate the affordability of a home purchase based on the consumer's income, expenses, and other financial obligations.

5. Credit Requirements: Information on the credit score and credit history requirements for obtaining a mortgage, along with tips for improving credit scores.

6. Pre-Approval Process: Explanation of the pre-approval process for obtaining a mortgage, including the required documentation and the benefits of being pre-approved.

7. Risks and Cautionary Points: Clear disclosure of potential risks and pitfalls of homeownership, such as the potential for foreclosure, market fluctuations, and unexpected expenses.

8. Legal Aspects: Information on the legal rights and responsibilities of homeowners, including the process of buying and selling property, mortgage contracts, and the role of homeowners' associations.

9. Resources and Support: References to additional resources, such as independent financial advisors, housing counseling agencies, and government programs that provide consumer protections or assistance.

It's important to note that this information may be provided through various mediums, such as government publications, educational websites, financial institutions, or housing counseling agencies, with the goal of promoting responsible homeownership and consumer caution.

How do I execute consumer caution and homeownership counseling notice online?

pdfFiller makes it easy to finish and sign consumer caution and homeownership counseling notice online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

Can I create an eSignature for the consumer caution and homeownership counseling notice in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your consumer caution and homeownership counseling notice and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How can I fill out consumer caution and homeownership counseling notice on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your consumer caution and homeownership counseling notice by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

Fill out your consumer caution and homeownership online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.